Welcome to issue #4 of TrueGrit.

FoodTech, particularly food delivery, has been one of the most heated sectors of discussion over the past five years and perhaps one that has attracted diverse critics and advocates from time to time.

My first exposure to the sector happened during my time at Unilazer, where I was part of the deal team that led an investment in Maroosh - a Lebanese cuisine focussed QSR chain. As part of the due diligence on the deal, I had the opportunity to learn about the nitty gritty of building and running a food business in India. It was fascinating to learn how global players like Dominos and McDonalds went about building their supply chain and last mile logistics in India at a time (mid-1990s) when the underlying infrastructure just didn't exist.

These learnings came in handy when I joined Accel in 2014. My first investment at the firm was in the food delivery space. I was very fortunate to co-lead (alongside a Partner) the fund's Series A (first institutional round) investment in Swiggy. At the time of investment, Swiggy was a small team doing ~100 transactions a day. Over the course of last 5 years the company has partnered with some of the best investors in the eco-system and grown to become one of the largest food delivery operators in the country. It was an immense pleasure to work with the founders (Sriharsha, Nandan and Rahul) and the early board and play a small part in the first three years of the company's journey.

I am taking the opportunity to share some thoughts on how the food delivery sector has evolved in India and the opportunities that lie ahead.

Evolution of India FoodTech (a quick recap)

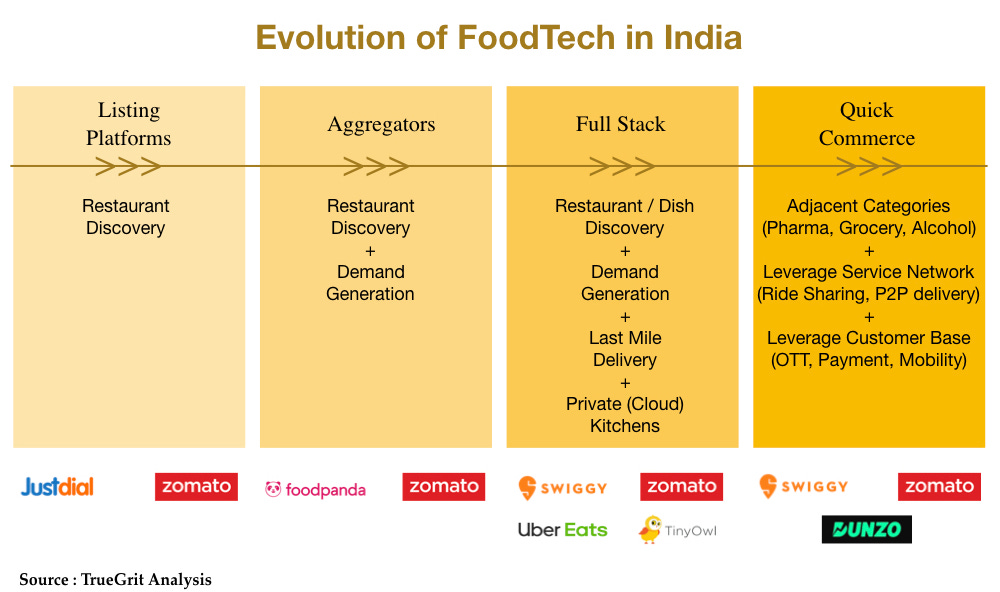

The food tech wave hit the Indian shores at the beginning of the decade when the first restaurant listing platforms (FoodTech 1.0) were launched.

Over time, as partnerships between the restaurants and food tech players deepened, the model evolved into an aggregator model (FoodTech 2.0), which focussed on restaurant discovery and demand generation but left last mile delivery to the restaurants.

While the aggregator model did well to address restaurant discovery and demand generation, it fell short on addressing the supply side economics (delivery boy efficiency, overhead costs, etc) as well as the consumer experience which was very broken (erratic delivery time, no real time order tracking, improper packaging, hygiene, etc) at the time.

These need gaps in the market gave birth to hyperlocal or on-demand aggregators (FoodTech 3.0), whereby these startups evolved to own the entire food stack (restaurant / dish discovery, curation, demand generation and last mile delivery).

We are now witnessing a fourth evolution of the sector whereby the large established food tech unicorns are leveraging their service expertise and customer base to expand into adjacent categories.

FoodTech 3.0 and The Gold Rush..

With the arrival of FoodTech 3.0, the sector experienced a surge in 2014 and 2015 - both in terms of startup inception and investment rounds.

There were more than 850 food tech startups founded in a two year span - some having identified a business model while most others still experimenting with various pivots.

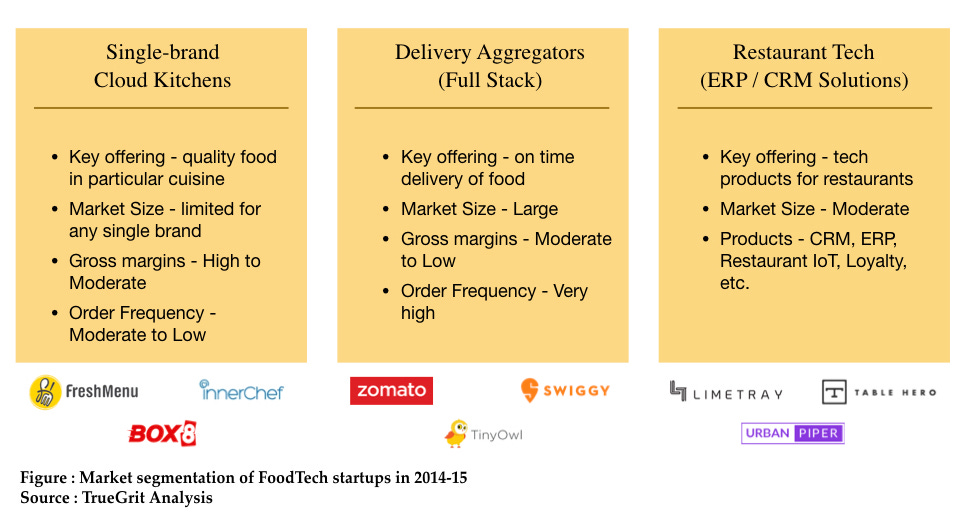

The market at the time could broadly be segmented into three key segments :

While the single-brand cloud kitchen model offered healthy gross margins, Delivery aggregators addressed a larger pain point and hence a larger market opportunity.

The 2015 surge was followed by a phase of recalibration in 2016-17, when many such single-brand cloud kitchen startups like Dazo, Spoonjoy, Eatlo, and EatOnGo, which enjoyed a healthy start, either had to shut shop or opt for distress sales / get acquihired. Faasos, which emerged strong in the segment, pivoted to a multi-brand cloud kitchen model and rebranded itself as REBEL foods.

While the full stack delivery aggregator segment did emerge as a winner, they too were faced with existential questions around unit economics and profitability.

After a city-level proof of viable unit economics, the food delivery segment witnessed a resurgence in 2018 when both Swiggy and Zomato raised large rounds of financing. We also witnessed some consolidation in the sector with Ola acquiring Foodpanda while Zomato acquiring UberEats India unit.

At present, the food delivery landscape in India is dominated by the following companies :

The Covid Impact

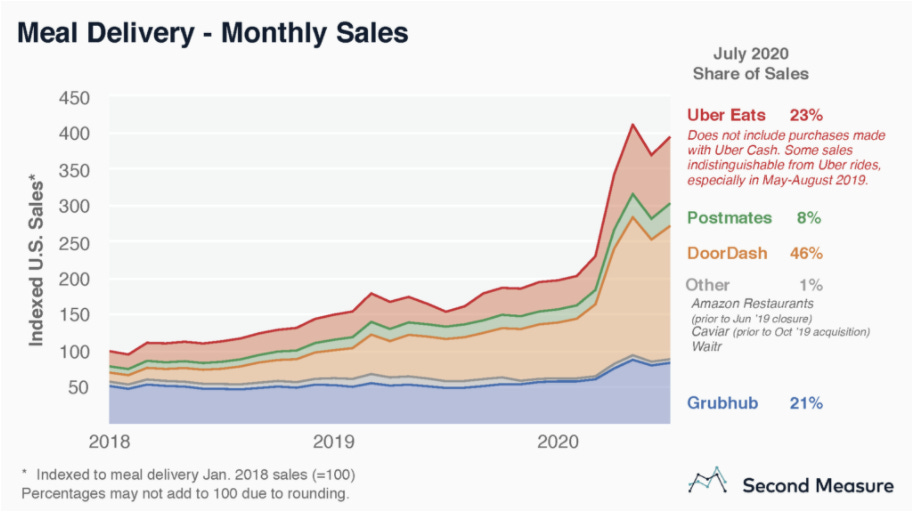

Globally, the food delivery segment has enjoyed strong tailwinds due to Covid as people switch to at-home dining from dining out. As per an analysis by Second Measure, the cumulative gross sales across the top four food delivery aggregators in US (DoorDash, UberEats, GrubHub, Postmates) nearly doubled during the pandemic.

In Europe, Delivery Hero (which is also a shareholder in Zomato by way of Zomato UAE acquisition) nearly doubled its market cap between the months of March and August.

Further, the months of pandemic have also witnessed some significant consolidation activity in the sector with Just Eat Takeaway announcing its acquisition of Grubhub for $7.3B in an all-stock deal and Uber announcing its acquisition of Postmates for $2.65B in an all-stock deal.

However, in India, food delivery has experienced severe negative impact due to Covid. In the early weeks of the spread, the delivery volumes for most online platforms declined to 20%-30% of pre-covid time. This reverse trend in the segment in India could be attributed primarily to three reasons :

Nationwide lockdown induced by coronavirus spread : the nationwide lockdown announced on 24 March 2020 led to an abrupt shutdown of the country leading to more than 95% restaurants listed on delivery platforms closing doors for food delivery.

Exodus of migrant workers : the lockdown also led to an exodus of migrant workers from major cities to their hometowns. These migrant workers form the bulk of delivery fleet for online food delivery operators. As such, even when the lockdown curbs were lifted, the delivery operators were faced with a supply problem and it took some time to get the supply up and running.

Consumer sentiment and a shift towards home cooking : in the early pandemic days, a delivery boy from one of the major delivery operators tested positive for Covid. This hurt the consumer sentiment and trust on the safety standards of food delivery operators, triggering a shift towards home cooking. Unlike US & Europe, where the alternative to dining-out is primarily delivery, in India the alternative can be either delivery or cooking at home.

As of September, the food delivery volumes have returned to 60%-80% of pre-covid time. This has been on the back of stringent safety measures (like double layered packaging, delivery boy sanitisation, food & kitchen sanitisation tracking, cashless payments, contactless delivery among others) put in place by delivery operators to win back customer trust. Further, these delivery operators have also tried venturing into adjacent categories like grocery, pharma and alcohol delivery to add to their top line by increasing the ARPU of the reduced customer base.

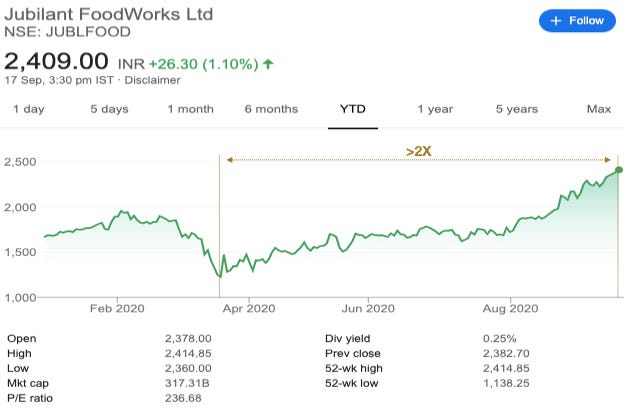

One of the food delivery companies' that has stood the test of Covid in India and deserves a mention here is Jubilant Foodworks - the company holds the master franchise of Dominos in India. The company's market cap has more than doubled since March.

FoodTech 4.0 and the Road Ahead

Enter the Giants!

Taking advantage of the decline in volumes for covid-struck Swiggy and Zomato, global tech giants - Amazon and Google - have both launched their own food delivery offerings in India. While this further validates the size of the opportunity in India, it throws a direct challenge to the homegrown Swiggy-Zomato duopoly.

Amazon, which is piloting Amazon Food in parts of Bangalore since May, will most likely operate on a similar model (to Swiggy and Zomato) by leveraging the service and delivery expertise it has built in the country through its offerings like Amazon Prime Now and Amazon Fresh.

However, Google will be operating on a third party model, much like how it operates in the US where the last mile delivery is fulfilled by the likes of DoorDash, Postmates, etc. In India, Google has partnered with Dunzo and other third party APIs for last mile delivery. It will be interesting to see if Google looks at Swiggy and Zomato as competitors or potential partners.

Emergence of 'Quick Commerce' : Quick Commerce is the next generation of e-commerce that focusses on an evolved consumer class (particularly single households, DINKs and elderly) that values speed, convenience and experience over price. This consumer class prefers purchasing small quantity small-ticket items over large-ticket discount driven purchases. The model takes advantage of centrally located cloud stores to provide a better customer experience than a traditional e-commerce model that relies on large warehouses built on the outskirts of the city. This Delivery Hero infographic below does well to explain the concept of quick commerce :

Given their expertise in logistics, technology, AI/ML and an existing customer base and delivery fleet, the food delivery operators in India are uniquely positioned to venture into quick commerce. Dunzo, which counts Google as one of its investors, has been an early mover into the space. More recently, we have also witnessed Zomato and Swiggy enter adjacent verticals like grocery, alcohol and pharma delivery. Quick commerce seems like a natural extension for food delivery operators to venture into.

Re-emergence of cloud kitchens

The dine-out segment has perhaps been the worst affected due to the pandemic with footfalls in most restaurants falling to below 20% of pre-covid time.

As per various industry reports, it is estimated that nearly 40%-45% of restaurants may go out of business due to the continued high lease rentals, increased fixed cost (due to new sanitisation and social distancing norms) and decreased footfalls.

The restaurants which adapt to delivery format and technology may survive but for the rest, the future unfortunately looks bleak unless a vaccine is launched soon.

This leads me to believe that the Cloud Kitchen model (aka virtual kitchens, dark kitchens, ghost kitchens) are set to make a comeback, albeit in a new avatar, in the post-Covid world.

The focus will be on building ground-up kitchens optimised for delivering high quality, hygienic and healthy food to customers. Newer SOPs will be adopted that ensure highest safety standards at every touchpoint. We may also witness greater kitchen automation (opportunities for robotics startups to shine) and dish level ingredient innovation.

As I see it, there could be three possibilities :

Increased listing on delivery platforms : existing standalone or small chain dine-out restaurants re-invent themselves as delivery only restaurants and take advantage of the existing delivery and commissary kitchen infrastructure offered by delivery aggregators

Multi-brand cloud kitchens : larger hospitality groups may choose to partner up and launch their own commissary kitchens using existing or new infrastructure and build multi-brand cloud kitchens akin REBEL foods.

Perhaps, a new cloud kitchen marketplace : that caters to delivery only stand-alone cloud kitchens and hence is able to offer better economics to the restropreneurs

Other trends and opportunities

Rise of subscription commerce : consumer trust, built on the back of high safety and sanitisation standards, will be pivotal to success of food delivery aggregators post covid. An increased trust in a platform or brand should lead to higher subscriptions. Subscription models built on high repeat high frequency items should gain greater acceptance post covid.

Kitchen automation and Restaurant IOT : With the adoption of new SOPs post covid, there would be an increased automation in kitchens and restaurants. While robotic food preparation is still a far cry, one can expect to see automated food assembly lines in kitchens and robotic service of food at restaurants and buffets.

Rise in Alternative Food categories : While globally the consumption of meat is on a decline, in India (much like in China), we are witnessing a rise in meat consumption with a rise in income. And since the meat consuming base is still small in India, I don't see much opportunity for meat analogues anytime soon. However, there could be immense potential in alternative protein (plant based or otherwise) and alternative milk (plant based, nut free, oat based, etc.) categories.

DIY models and Direct to Consumer brands : Packaged food brands, particularly in categories like healthy snacking, vegan food and ready to eat meals, should witness a surge in consumer demand. Further, DIY startups and meal-kit providers should finally find an audience among Indian consumers who have found a new love for cooking at home. These DIY startups and D2C brands could leverage the service expertise and delivery infrastructure built by delivery aggregators to reach the customer directly.

At-home experiences : Since restaurants are now forced to operate at a 30%-50% capacity, many will start offering at-home experiences for small groups of people in order to meet restaurant economics. Further, high profile chefs, who specialized in premium dine-in experiences may also switch to offering at-home boutique experiences. Discovery and booking of such experiences could be a great stand-alone opportunity for an online marketplace or an additional vertical for food delivery operators to venture into.

The FoodTech space is always evolving and I can't wait to see what the future holds. Happy to share my perspective incase you're an investor investing in the sector or an entrepreneur trying something new in the space.

This article was first published on LinkedIn.

I started this newsletter on persuasion by a few friends & colleagues who found my article on VC fundraising informative. I’d be delighted to hear your feedback, questions, and comments!

You can also follow me on linkedin or twitter. If you liked the article, please share on your social channels.

Disclaimer : all thoughts, views and opinions expressed in this article are my own and do not represent the opinions of any entity whatsoever with which I have been, am now or will be affiliated in future. Further, the article is not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, and may not be used or relied upon in evaluating the merits of any investment. The content should not be construed as or relied upon in any manner as investment, legal, tax, or other advice.

Facts * ,not fat :-)..apologies

Loads of fat ,thank you so much,is there any data we can access to with regard to immunity bldg foods ,meal plans , change of health index ? We offer our clients free immunity meal plans for the family , we too awaiting their feed backs .