Welcome to issue #5 of TrueGrit.

In the last few months, I shared some learnings from my fundraising experience as well as dived deeper into a few market / sectoral opportunities in my newsletters on MENA ecosystem (#2), India Agritech (#3) and India Food Delivery (#4).

In this edition, I discuss some insights from three extraordinary reports I came across last month on D2C brands, Social Commerce and SaaS as well share my thoughts / commentary on some of these opportunities in India.

I hope this edition helps entrepreneurs / investors looking to build / invest in these sectors.

Report 1 : “D2C Brands : Disrupting the next decade of shopping” by Avendus

Key insights from the report :

India D2C brands TAM —> $100B (2025F)

Number of D2C brands launched since 2016 —> 600+

Number of VC backed D2C brands —> 100+ ($1.6B+ cumulative VC funding)

Number of brands with $50M+ annualised revenue run-rate —> 16

Number of brands with $15M+ annualised revenue run-rate —> 45

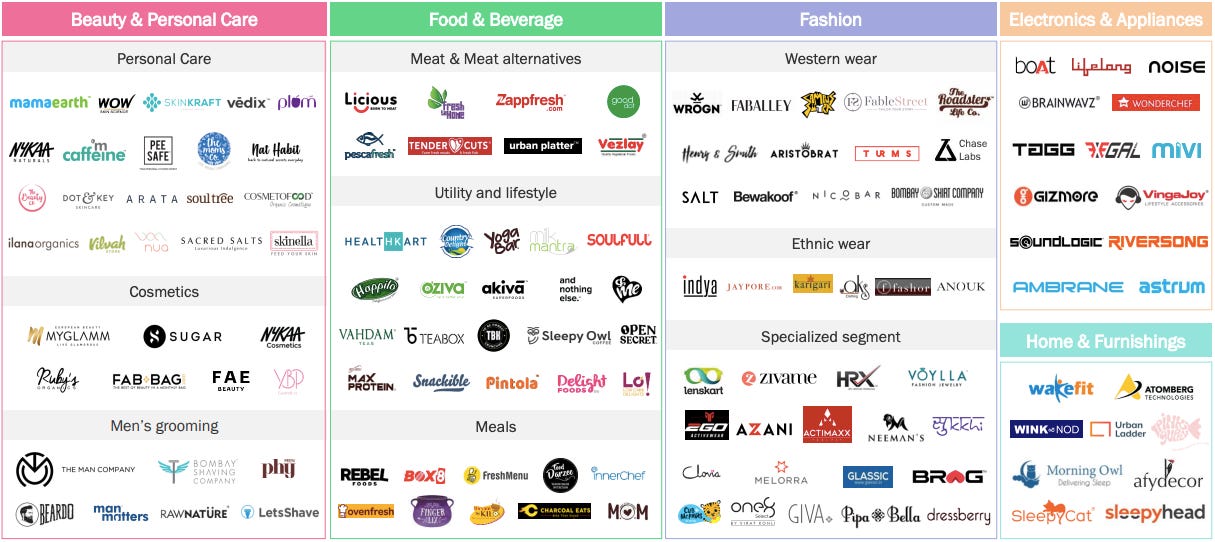

India D2C player landscape👇

Key Categories :

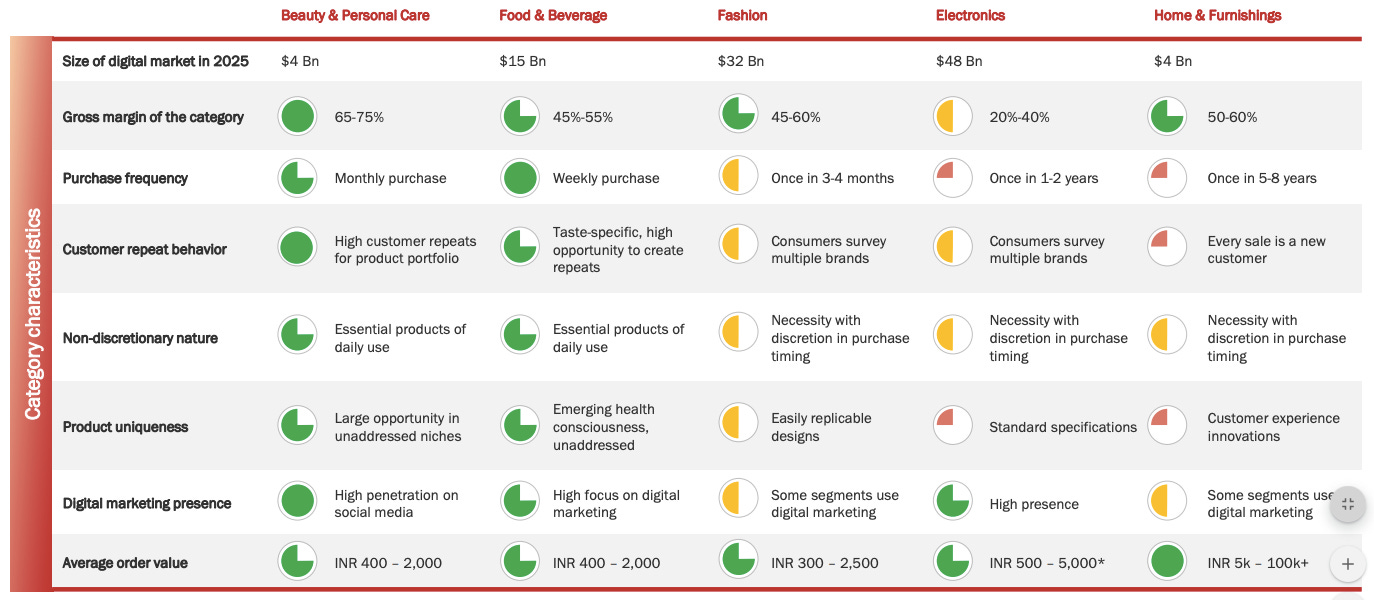

Beauty & Personal Care :

👉 $28B TAM (2025F), of which $4.4B online market growing @29% 5-year CAGR

👉 80+ D2C brands across beauty, personal care, cosmetics and men’s grooming

👉 ~70% product margins in the category

Food & Beverages :

👉 $1T TAM (2025F) of which $15B online market

👉 100+ D2C brands across meat, dairy, healthy snacks & beverages

👉 ~50% gross margins in the category

Fashion :

👉 $185B TAM (2025F) of which $32B online market growing @24% 6-year CAGR

👉 45% organised share of market in India by 2025

👉 ~50% gross margins in the category

My thoughts on the India D2C opportunity :

The D2C brand ecosystem in India has grown many-folds in the last decade on the back of increasing internet / smartphone penetration, increasing disposable income, rising number of online buyers and evolving consumer buying behaviour. COVID has further accelerated the digital adoption in the nation driving a big shift from offline retail to online.

The Indian consumer is now looking for variety and convenience and is willing to pay a premium for high quality products / services.

Fashion (100+ brands), Food & Beverages (100+ brands) and Beauty & Personal care (80+ brands) have emerged as the largest categories in the Indian D2C landscape.

As I see it, the most successful D2C brands in India were built to address specific need-gaps that existed in niches within a larger category.

A few good examples within the fashion category would be Zivame (lingerie), Lenskart (eyewear) and HRX (active wear). Each of these brands solved for the poor offline shopping experience for the consumer — Zivame (fit, personalisation, variety, etc.), Lenskart (variety, price, etc.) and HRX (variety, functionality, etc.) — using technology, supply chain innovation, customer education and unique marketing & distribution strategies.

Similarly, in the Beauty and Personal care category, Sugar Cosmetics (Colour cosmetics), Mamaearth (Toxin-free personal care) and Bombay Shaving Company (Men’s grooming) are good examples of brands that innovated on business model and product / price white space in the market.

Lastly, in the F&B category, companies like Licious (Meat Delivery), Country Delight (Milk & Dairy) and YogaBar (Healthy snacking) are leading the charge in their niches. These companies are solving for adulteration, supply chain complexities, procurement of quality ingredients, packaging among other things.

Most D2C brands in India started with a digital-first approach with a clear strategy to go omni-channel and tap into a larger TAM once the brand was established. The brand’s own platform was used for brand creation, customer education and gaining customer insights while the marketplaces were used for reaching a broader audience and reducing the overall CAC. As these brands matured, they expanded to adjacent categories as well as offline distribution via MBOs and exclusive stores.

Over the years, with increasing digital penetration, we have now also started witnessing many successful ‘digital-only’ brands scale — Boat (Audio products), WOW (Personal Care) and WakeFit (Mattress / Sleep accessories) are a few good examples.

As the D2C brand ecosystem develops further, I am most excited about opportunities in the following categories :

High depth, high purchase frequency categories that offer high gross margins on moderate AOV :

High AOV, moderate purchase frequency categories that offer high margins with a clear early mover advantage :

Report 2 : ‘The Future of Commerce in India’ by Sequoia and Bain & Company

Key insights from the report :

India social commerce market size :

👉 $1.5-$2B (2019) —> $16-$20B (2025E) —> $60-$70B (2030E)

What’s driving Social commerce?

👉 572M internet users —> 105M online buyers —> spend $286/ year —> spend >3hrs online —> spend >2 hrs on social media networking, messaging & video

Buyer profile :

👉 also transacts on e-commerce platforms

👉 driven by variety/ personalisation, community connection, fun shopping experience, price and trust

👉 prefers purchasing from small trusted groups

👉 40-50% don’t know what to buy

👉 exhibits low brand stickiness

👉 five predominant archetypes of social commerce consumers 👇

Seller profile :

👉 63M+ MSMEs in India —> 40M digitally enabled —> 10M-15M leveraging social for commerce

👉 85% sellers are small retailers —> derive 35% revenue from social commerce

👉 larger retailers prefer selling on reseller platforms

👉 driven by ease of selling, wider customer reach, attractive CAC, better margins than traditional e-commerce

Key Categories & Drivers

👉 Fashion & Home Decor —> variety and customisation, community connection, fun shopping experience

👉 Beauty & Personal Care —> variety and customisation, community connection, trust

👉 Food & Groceries —> convenience, trust, price

Models of social commerce —> growth drivers —> key players

👉 Video led —> fun & engaging —> BulBul, SimSim

👉 Social network led —> community connect —> Facebook, Instagram

👉 Social reselling —> curation / variety —> Meesho, GlowRoad, Shop101

👉 Conversation / chat led —> convenience —> WhatsApp, telegram

👉 Group buying —> price —> DealShare, Mall91

My thoughts on the Social commerce opportunity in India :

Venture capital investing is cyclical in nature. The investment themes tend to repeat after every 12-15 years albeit on the back of new consumption behaviour, new technology, innovation in business models and marketing/ distribution channels, etc.

We witnessed the growth of e-commerce in India over the last decade. From the first horizontal e-commerce marketplaces to vertical e-commerce to D2C brands across all categories of retail. We now have a full-fledged e-commerce enabler eco-system in play that also expands to long tail categories.

Social is the next frontier for e-commerce. As I see it, social commerce will evolve in a similar manner as E-commerce but at a much faster pace. This will offer tremendous opportunities to build across the value chain :

Report 3 : ‘India SaaS Report 2020’ by Bain & Company

Key insights from the report :

Global SaaS market size —> ~$145B (2019) —> ~$230B (2022E)

India’s market share —> 3%-4% (2019) —> 7%-9% (2022E)

India’s SaaS market size —> $5B-$6B (2019) —> $18B-$20B (2022E)

India SaaS Landscape :

👉 ~8K SaaS companies

👉 ~1.2K VC funded

👉 40+ Series C funded & above

👉 50+ companies with $10M+ ARR

👉 5 companies with $100M+ ARR

Three distinct archetypes of SaaS companies in India :

Four Key Segments :

👉 SMB Focused SaaS —> Zoho, Freshworks

👉 Vertical-specific SaaS —> Locus, Innovaccer

👉 Emerging tech —> Postman, Hasura

👉 India initiators

—> Pure-play SaaS —> Darwinbox, MyGate, Yellow Messenger, Vernacular.ai

—> SaaS-enabled B2B platforms —> Ninjacart, Freight Tiger, Infra.Market

Six key future investment themes :

👉 Infrastructure management tools & platforms for developers —> eg : Hasura, LambdaTest

👉 Increase in remote working leading to scaling of more collaboration & productivity tools —> eg : Airmeet, Flock

👉 Tools fuelling the API economy —> eg : Postman, Setu, YAP

👉 Intelligent automation of business processes driven by advanced AI /ML & cognitive computing —> eg : Vernacular.ai, Observe.AI (Speech recognition) and Yellow Messenger (Chatbots)

👉 Disintermediation of value chains and rise of B2B tech platforms / marketplaces —> eg : Ninjacart

👉 E-commerce enablement solutions with differentiated tech capabilities —> eg: Vue.ai (recommendation / personalisation), Avataar.me (assisted selling), Instamojo (SMB payments), LoveLocal (DukaanTech)

2020 India SaaS Deal activity :

Some other thoughts / discussions from last month..

👉 On DoorDash and its IPO —> here and then some here.

👉 On Airbnb and its IPO —> here

👉 On standard venture capital terms —> here

That’s all folks! Wishing you all a very happy holidays and a fantastic new year 2021. I’ll be back with the sixth edition in January.

I started this newsletter on persuasion by a few friends & colleagues who found my article on VC fundraising informative. I’d be delighted to hear your feedback, questions, and comments!

You can also follow me on linkedin or twitter. If you liked the article, please share on your social channels.

Thanks for sharing this wonderful insights , happy to know your views about the high margin Laundry Space booming up in India off lately ..Regards Prashant Dua

Quite an interesting take on D2C brands. Over the years niche startups have grown rapidly when compared with Marketplaces.